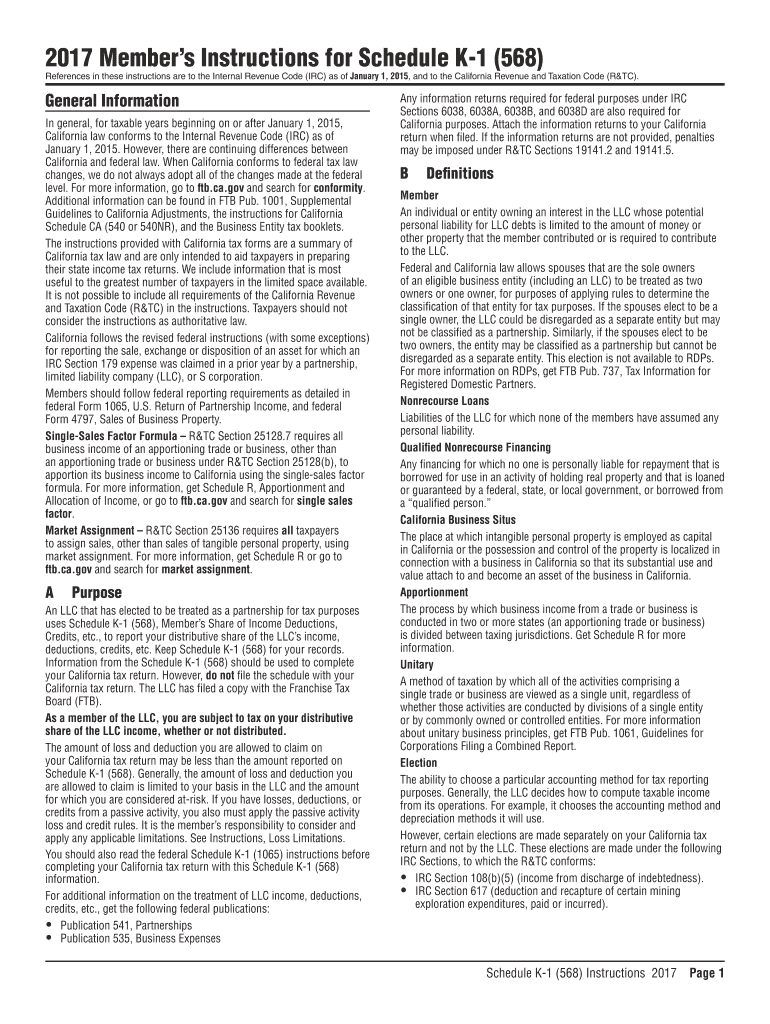

2024 Schedule K-1 Instructions Pdf – Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust, including income as well as credits, deductions and profits. A K-1 tax form inheritance statement must be . ETNs and ETFs can provide exposure to the midstream/MLP space without the headache of a Schedule K-1, but there are important nuances to consider when choosing the right vehicle for an investor .

2024 Schedule K-1 Instructions Pdf

Source : www.dochub.comL501 Download 2020 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comInstructions for Forms 1099 MISC and 1099 NEC (Rev. January 2024)

Source : www.irs.govDiversity Visa Instructions

Source : travel.state.govSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.coGuggenheim New York Announces 2024 Schedule of Exhibitions | The

Source : www.guggenheim.orgCalendars Dare County Schools

Source : www.daretolearn.org2023 Instructions for Form 1041 and Schedules A, B, G, J, and K 1

Source : www.irs.govHome

Source : www.adea.orgFederal Register :: Medicare and Medicaid Programs; CY 2024

Source : www.federalregister.gov2024 Schedule K-1 Instructions Pdf Ca 568 instructions: Fill out & sign online | DocHub: Instead, the partnership reports each shareholder’s pro rata share of income and expense items on Schedule K 1 before mailing to the IRS Service Center indicated on Page 4 of the instructions. . Pass-through entities use a tax form called Schedule K-1 to report a partner’s or shareholder For more on qualifying as an S-corp, see the instructions to Form 2553. A C corporation .

]]>

.png?n=1630)