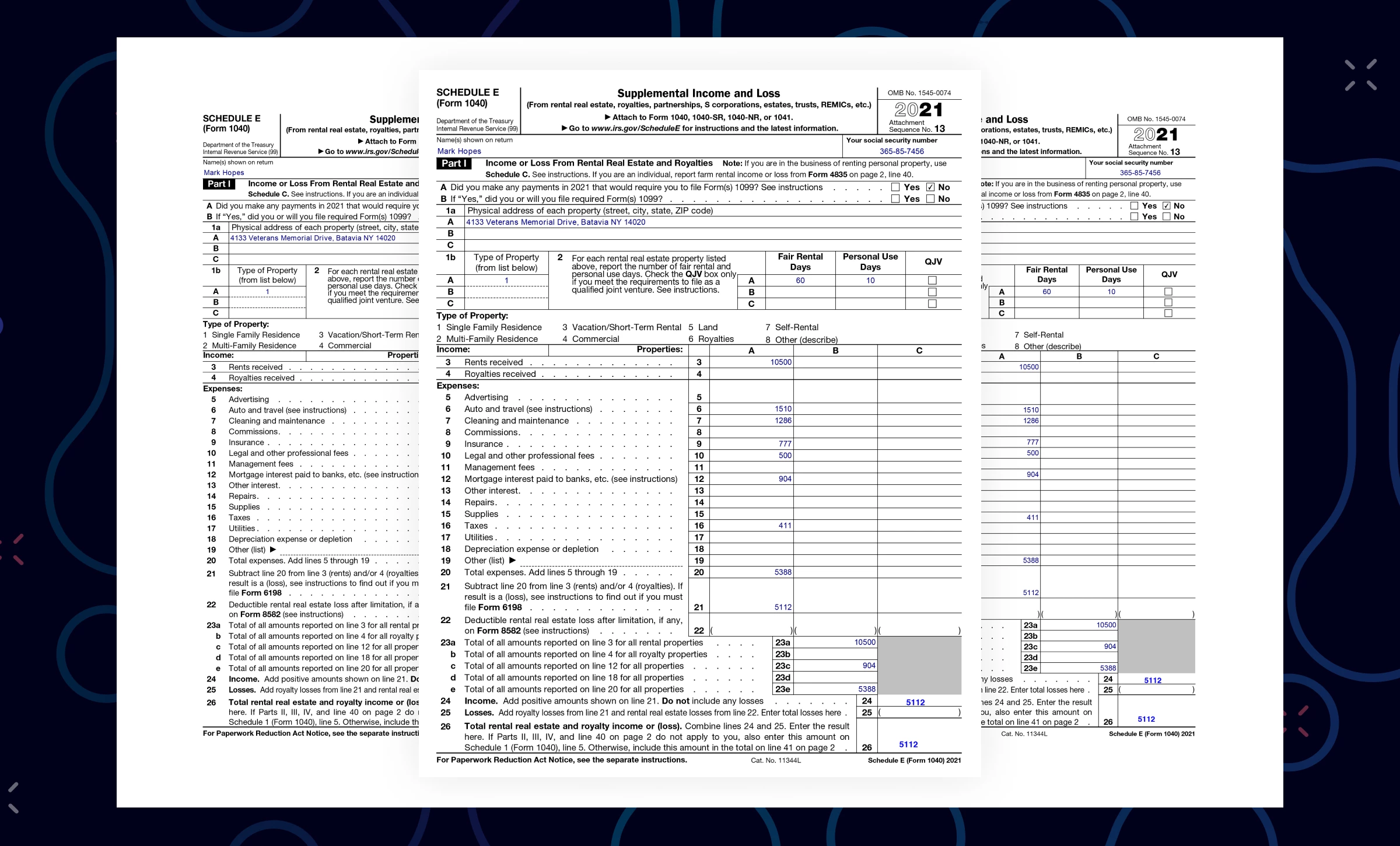

2024 Irs Schedule E Form 1040 – A new Form 1040 tax software to file are unlikely to even notice. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to . I cover individual tax issues and IRS developments. E-filing for individual tax returns (Form 1040) will open on Monday, January 23, the IRS recently announced. The Service will begin accepting .

2024 Irs Schedule E Form 1040

Source : www.ocrolus.comIRS Schedule E (1040 form) | pdfFiller

Source : www.pdffiller.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

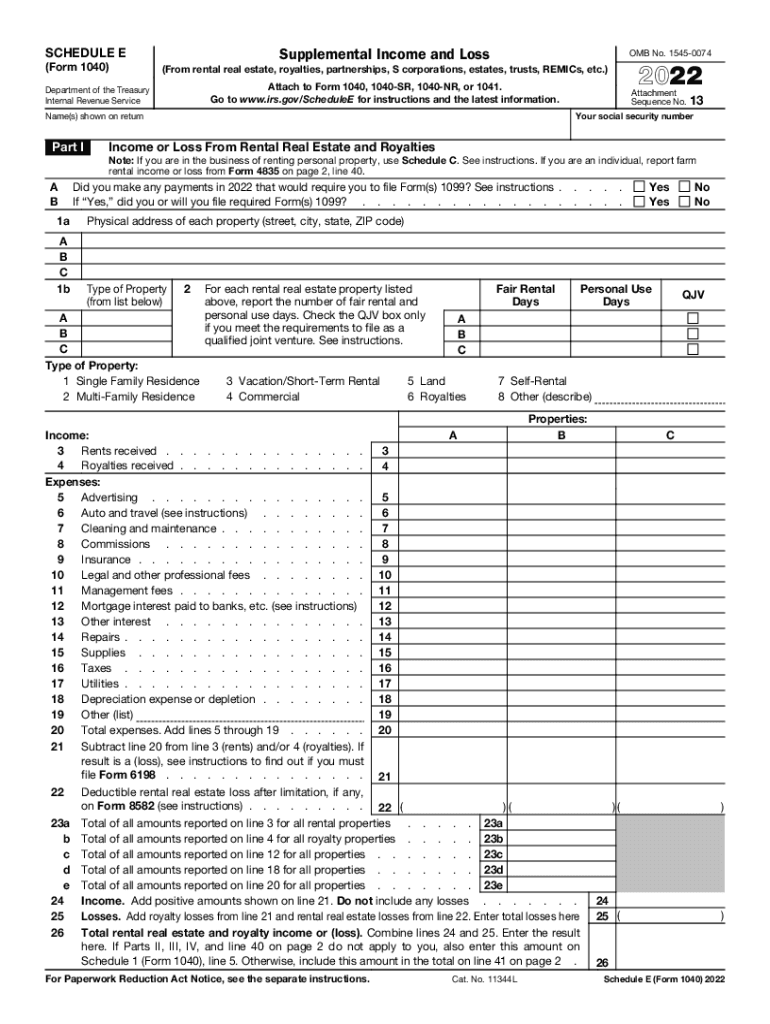

Source : www.reddit.comTax form schedule e: Fill out & sign online | DocHub

Source : www.dochub.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.greatland.comAbout Schedule E (Form 1040), Supplemental Income and Loss

Source : www.irs.gov2024 Irs Schedule E Form 1040 IRS Form 1040 Schedule B 2021 Document Processing: You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . The deductions are documented on Internal Revenue Service Schedule C, which is filed with the small business owner’s Form 1040. Workers’ compensation premiums are only deductible when they are .

]]>